child tax portal still says pending

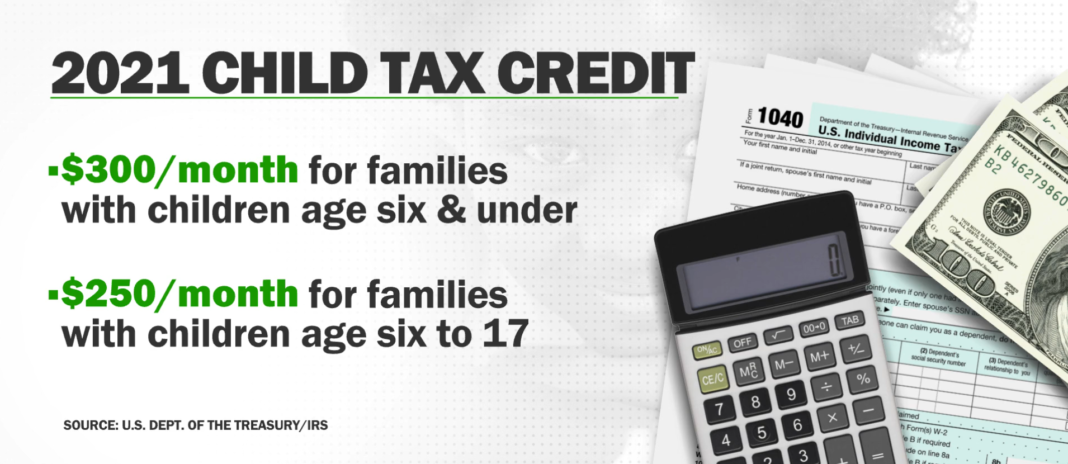

To reconcile advance payments on your 2021 return. The first advance payments of the bulked-up child tax credit are poised to go out to millions of American families in just over two weeks on July 15 -.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

If the portal says a payment is pending it means the IRS is still reviewing your account to determine your eligibility.

. I helped her set up the child tax credit portal which shows that her status is pending and that she will not receive monthly tax credit payments at. Portal still says pending eligibility I received July and August just fine but early September the portal changed to pending eligibility. Get your advance payments total and number of qualifying children in your online account.

If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you qualify. 30 2021 at 207 PM PDT. The next monthly payment is slated to go out at the end of this week around Oct.

Will I still get my monthly payment if my status is pending. Childtaxcredit Part 10 What does pending status mean. The IRS has now processed the sixth December and final round of advance 2021 monthly payments for the expanded Child Tax Credit CTC to parents and guardians with eligible dependents.

WASHINGTON The Internal Revenue Service has upgraded the online tool that allows families to update their bank account information so they can receive. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account. If Married Filing Jointly If Letter 6419 Has a Different Advance Payments Total.

The advance payments accounted for 50 of the credit you were due with the remainder and any adjustments to be claimed via your 2021 tax. Pending Eligibility The IRS is still reviewing. 23K Likes 222 Comments.

Households that claim children as dependents on their taxes get up to 250 a month for. I am qualified and received the first letter. Child tax portal still says pending Wednesday June 8 2022 Recipients can check the status of the monthly payment at the IRS Child Tax Credit Update Portal.

If all else fails you can plan to claim the child tax credit when you file your 2021 taxes next year. After talking to the IRS and finding out this was a glitch and happened to others I had some hope but there is still no change as of. One thing to keep in mind is that the IRS is targeting the payment dates see above.

What if my child tax credit check doesnt arrive on time. In January 2022 the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you during 2021. The Child Tax Credit Update Portal is no longer available.

New Child Tax Credit Q A Part 10 What does pending eligibility mean. The first stage will begin to reduce your child tax credit to 2000 if your adjusted gross income in 2021 is greater than 150000 for most. TikTok video from The News Girl lisaremillard.

The IRS is providing eligible families with payments ranging from 250 to 300 per. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. According to the IRS you can use the Child Tax Credit Update Portal to see your processed monthly payment history.

Even during normal times it takes about four months for the IRS to process an amended return. My status on IRS portal says my CTC is pending. You can also refer to Letter 6419.

Itll be a good way to watch for pending payments that havent gone through your. Enter your information on Schedule 8812 Form 1040. The IRS wont send you any monthly payments until it can confirm your status.

Please keep this letter regarding your advance Child Tax Credit payments with your tax records. Parents are upset that they received letter 6417 from the IRS confirming that their children were eligible for the advance payments but when they checked their status on the IRS online portal they. In some cases taxpayers who believe theyre eligible for the payments may find their eligibility listed as pending on the Child Tax Credit Update Portal.

July 16 2021 725 AM Sorry--no you cannot get your tax refund until the IRS completes the processing of your tax return. During the pandemic and due to the severe backlog at the IRS it is taking much longersix months or more for many amended returns. President Biden and a handful of Democratic lawmakers have said they hope to.

Do I still get the monthly child tax credit. Topic E if the IRS has not processed your 2020 tax return as of the payment determination date for a monthly advance Child Tax Credit payment we will determine the amount of that advance Child Tax Credit payment based on information shown on your.

Child Tax Credit August Update How To Track It Online Marca

2021 Child Tax Credit What To Do If You Get Message Your Eligibility Has Not Been Determined As Usa

When Parents Can Expect Their Next Child Tax Credit Payment

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit What To Do If You Get Message Your Eligibility Has Not Been Determined As Usa

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Where Is My August Payment

Child Tax Credit Updates Why Are Your October Payments Delayed Marca

Child Tax Credit Will There Be Another Check In April 2022 Marca

The Advance Child Tax Credit What Lies Ahead

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Advance Payments Of The Child Tax Credit I M Definitely Eligible Why Does It Says I M Not R Irs

Latest Child Tax Credit Payment Delayed For Some Parents Cbs News

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Irs Child Tax Credit Payments Start July 15

Irs Offers New Details On Glitch That Delayed Child Tax Credits Top Stories Nny360 Com

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Child Tax Credit Now Available To Puerto Rico Puerto Rico Report